Dear friends,

Welcome to the March issue of Mutual Fund Observer.

I am surprised, sometimes, at how much I now appreciate some of the stuff that I found most mindless and annoying in high school. (I’m still not there with Moby Dick; the whole idea of a monomaniacally obsessed old guy leading his ship to destruction because he can’t be reasoned with and won’t back down, just strikes me as implausible, but I’m willing to listen.)  My secret hope as a professor is that I’m like the gardener scattering seeds too early, in patches that seem disconsolate, for those seeds still sprout whither they would. And so, I teach my students about Thorstein Veblen, one of his age’s most impenetrable geniuses (he coined “conspicuous consumption”), and Sherry Turkle, one of our age’s most thoughtful, who asks “What do we become when we talk to machines?” We read about Hitler, and about the disastrous misjudgments – by mainstream politicians who had faith that they could control him and German industrialists who had faith that they could harness him to their everlasting profit – that led to the rise of Hitler. We read the reflections of the decent, hardworking Germans who convinced themselves that it was better to keep their heads down and pray.

My secret hope as a professor is that I’m like the gardener scattering seeds too early, in patches that seem disconsolate, for those seeds still sprout whither they would. And so, I teach my students about Thorstein Veblen, one of his age’s most impenetrable geniuses (he coined “conspicuous consumption”), and Sherry Turkle, one of our age’s most thoughtful, who asks “What do we become when we talk to machines?” We read about Hitler, and about the disastrous misjudgments – by mainstream politicians who had faith that they could control him and German industrialists who had faith that they could harness him to their everlasting profit – that led to the rise of Hitler. We read the reflections of the decent, hardworking Germans who convinced themselves that it was better to keep their heads down and pray.

This separation of government from people, this widening of the gap, took place so gradually and so insensibly, each step disguised (perhaps not even intentionally) as a temporary emergency measure or associated with true patriotic allegiance or with real social purposes. And all the crises and reforms (real reforms, too) so occupied the people that they did not see the slow-motion underneath, of the whole process of government growing remoter and remoter. . . (A German professor speaking with Milton Mayer, They Thought They Were Free: The Germans, 1933-45. University of Chicago Press, 1955)

We read the final report of Herbert Hoover’s 1929 Committee on Recent Economic Changes that hailed an “almost insatiable appetite for goods and services,” and envisaged “a boundless field before us … new wants that make way endlessly for newer wants, as fast as they are satisfied.”

The kids from Nepal and Mongolia read it alongside the kids from Naperville and Milwaukee, read it very differently from one another, and speak to each other with increasing confidence about how they connect to the readings … and connect to each other.

And so, in the spring of my 41st year at the college, I’ll continue scattering seeds and nurturing hope.

Heck, perhaps one day they’ll reflect on my classes as I’ve reflected on Dickens.

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

― Charles Dickens, A Tale of Two Cities (1859)

In this month’s Observer

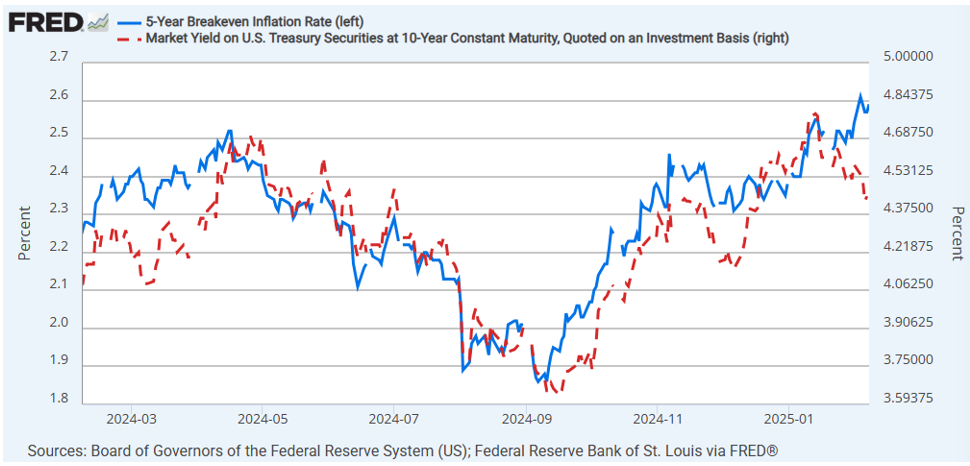

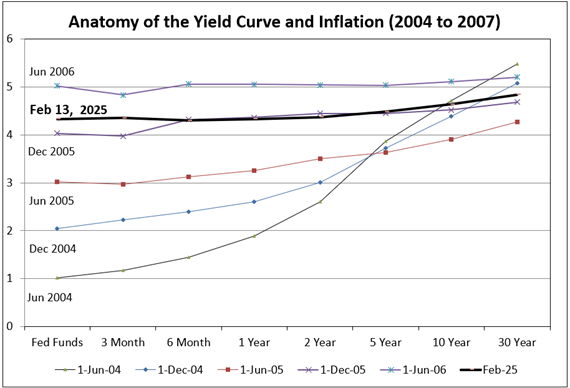

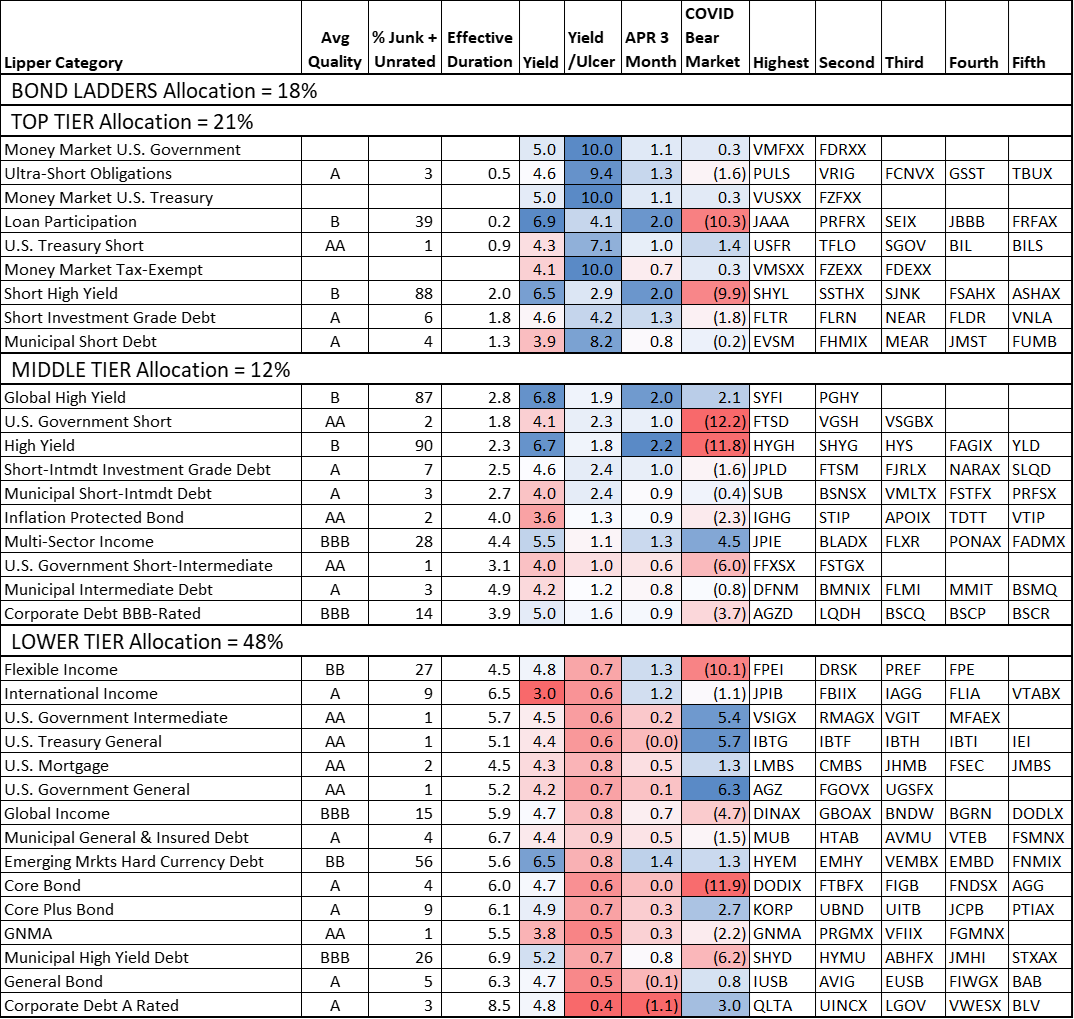

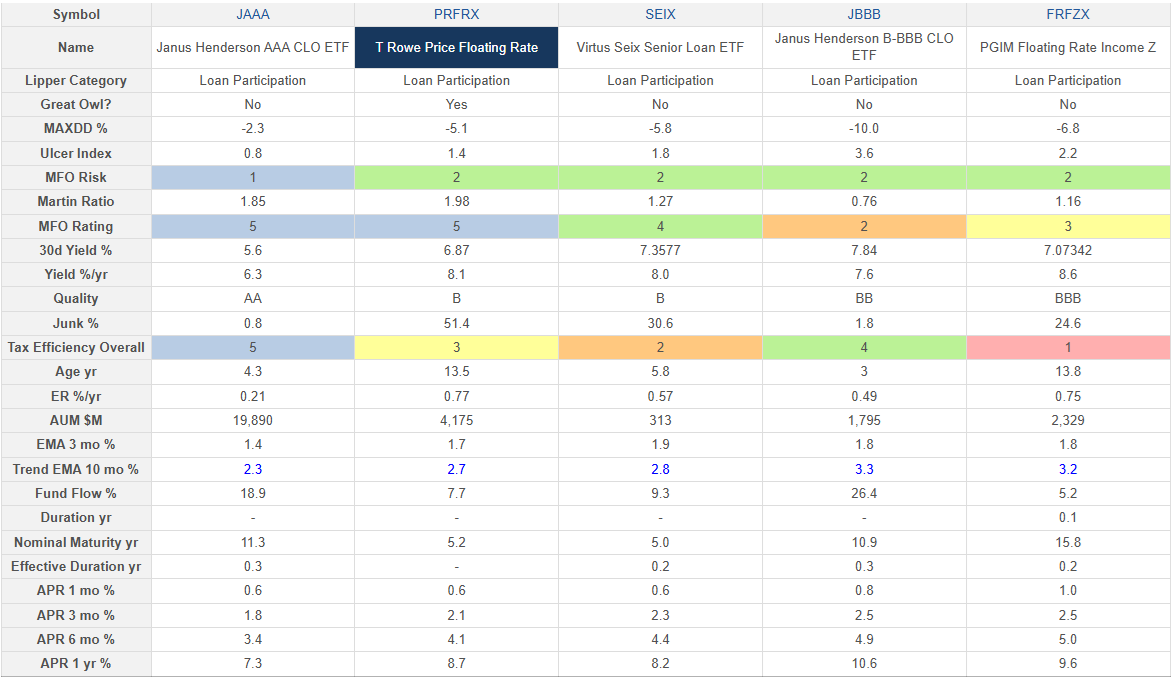

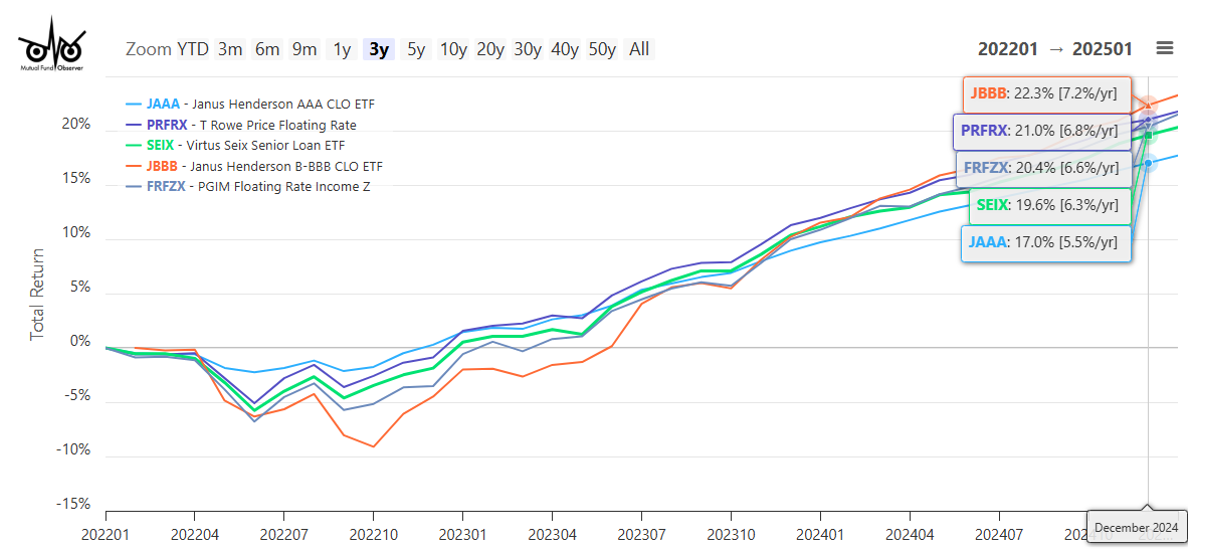

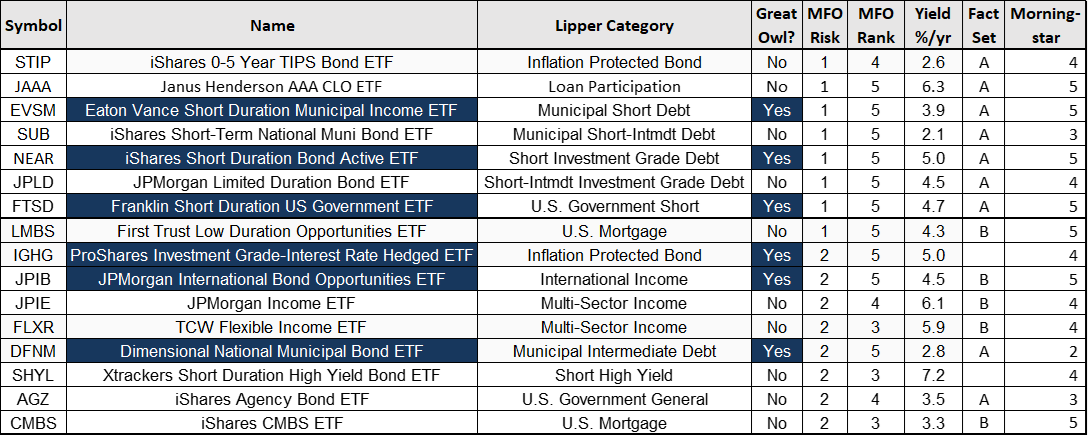

Our colleague Lynn Bolin continues looking at bonds as an attractive alternative, on a risk-adjusted and valuation basis, to stocks just now. “Spicy Bond Funds” explores “spicier” (higher-yielding) bond investments in the current market environment. Lynn analyzes various risk factors including inflation, duration risk, and policy uncertainty, and provides a comprehensive ranking system for bond funds. Spoiler: you might want to check Janus Henderson AAA CLO ETF (JAAA) as a relatively safe way to achieve higher yields in the current market,

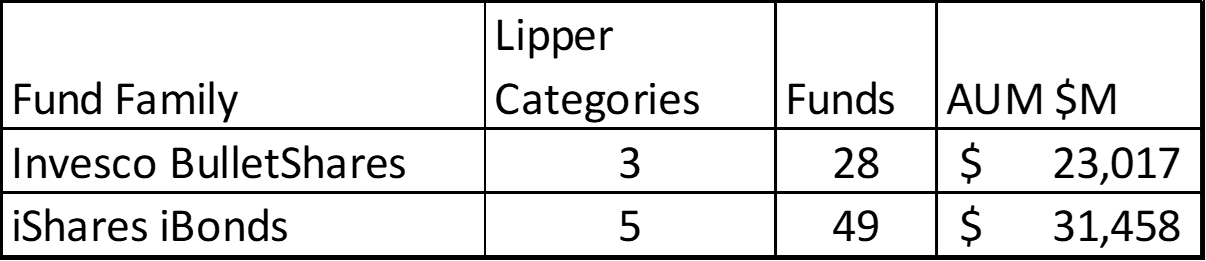

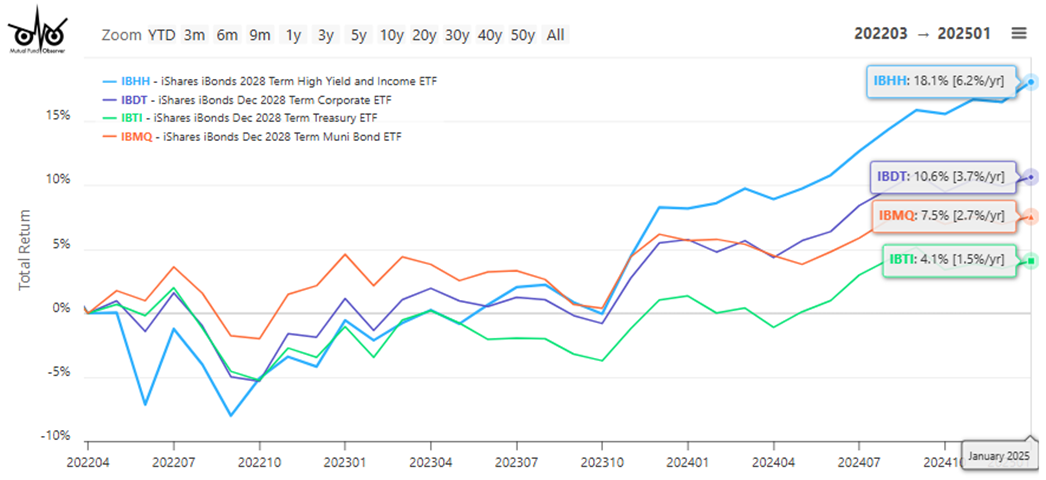

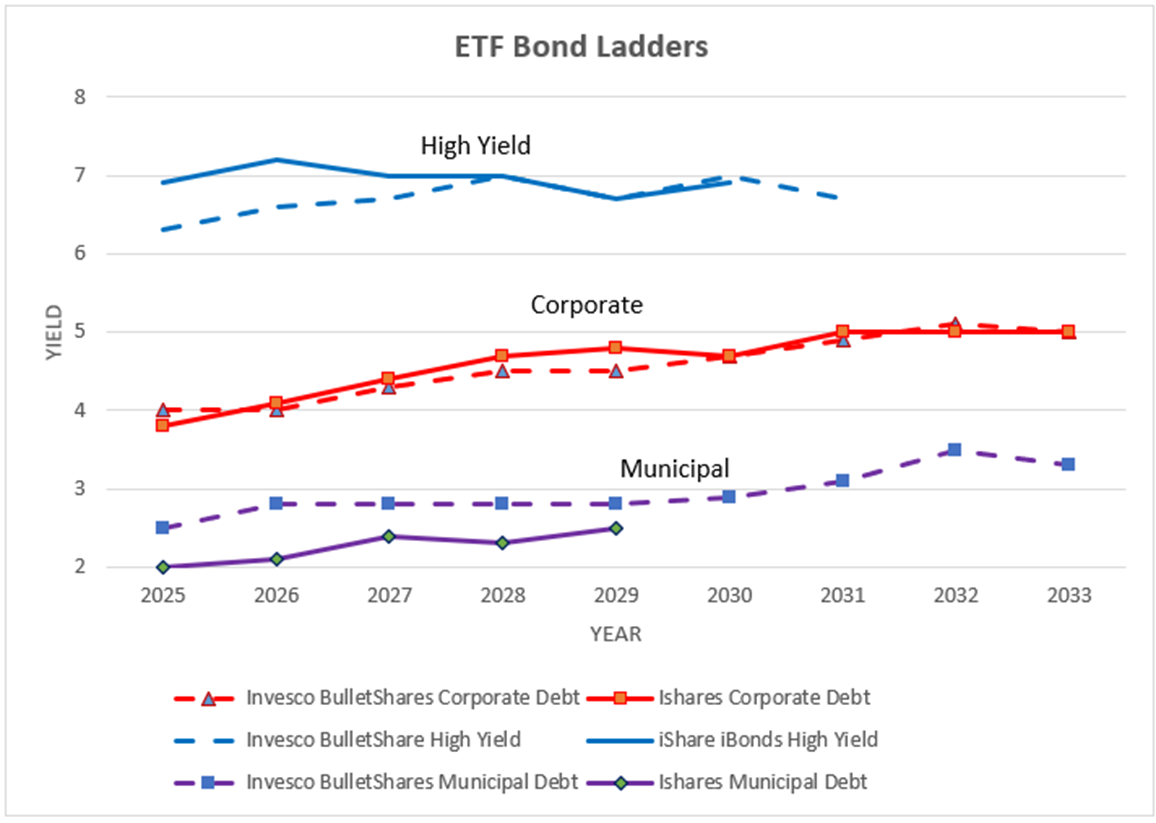

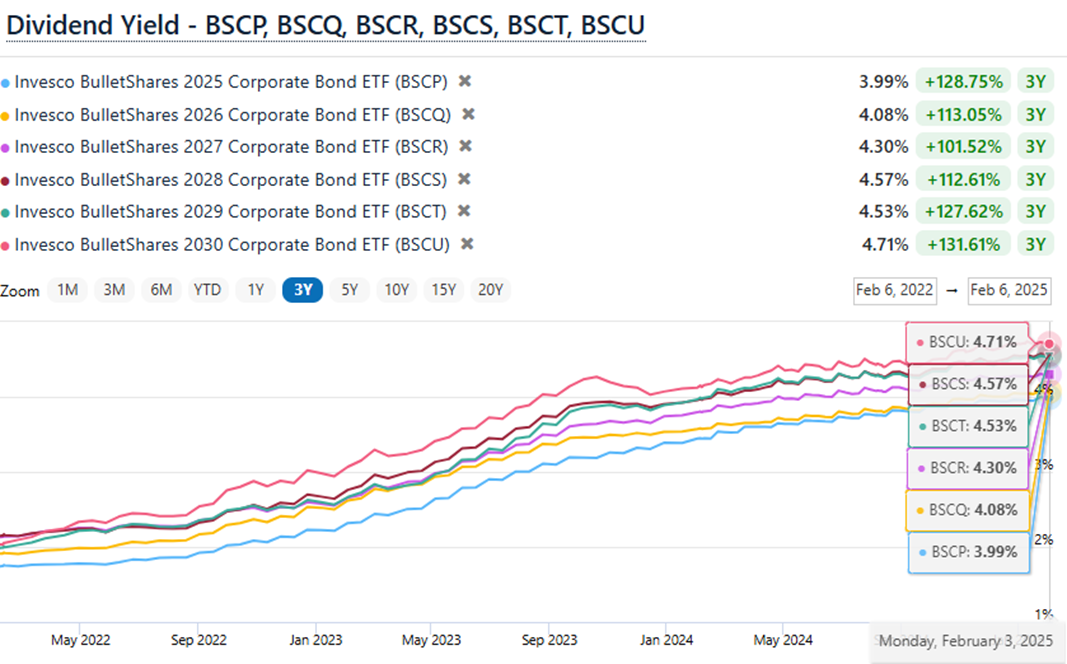

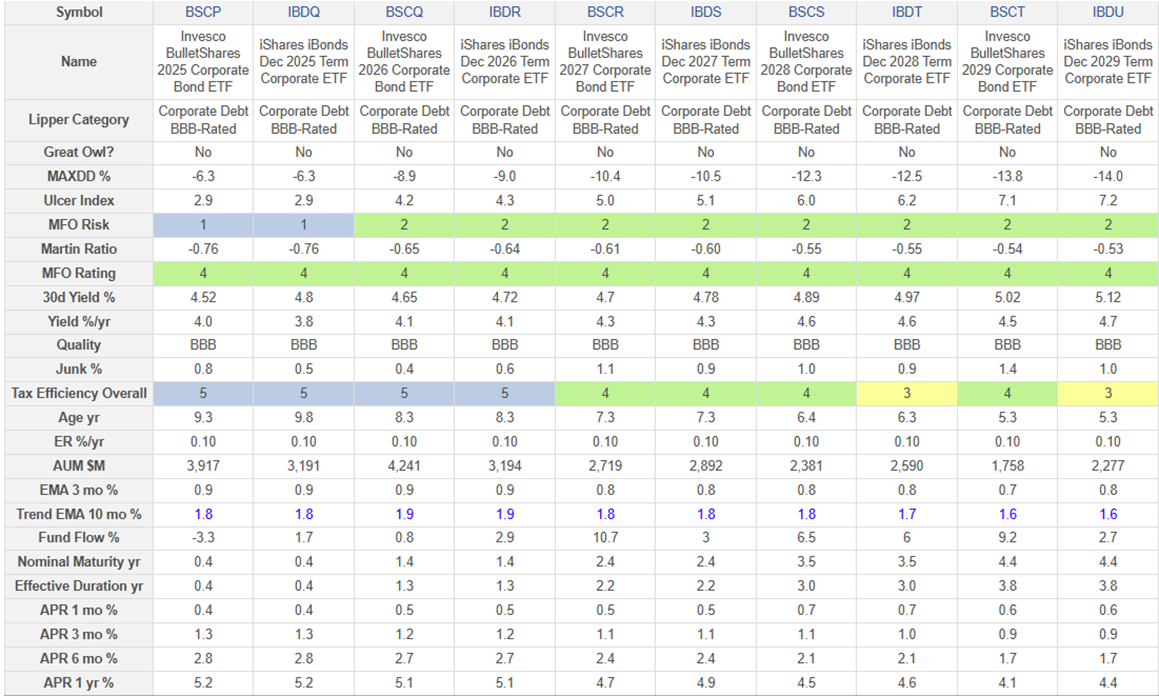

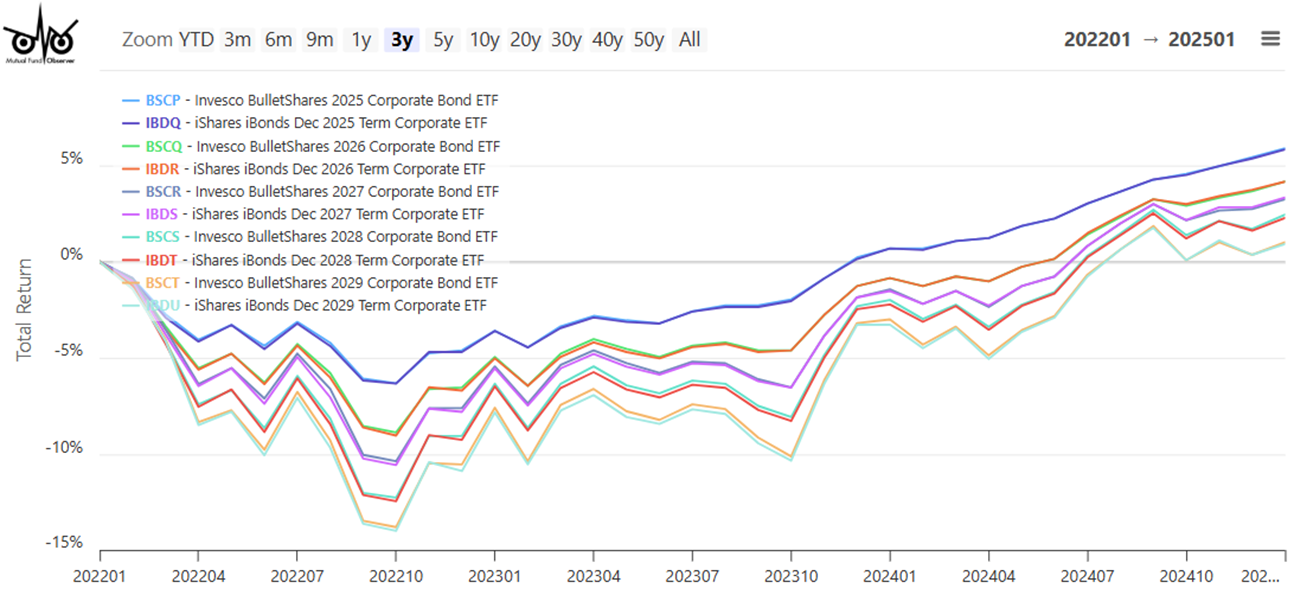

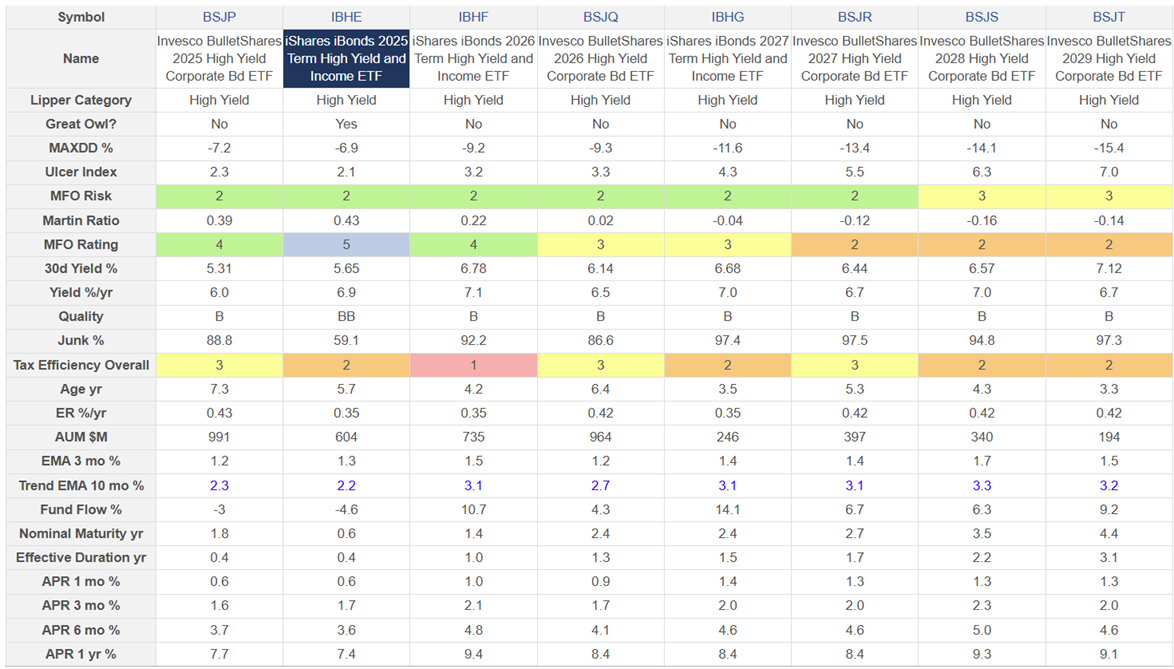

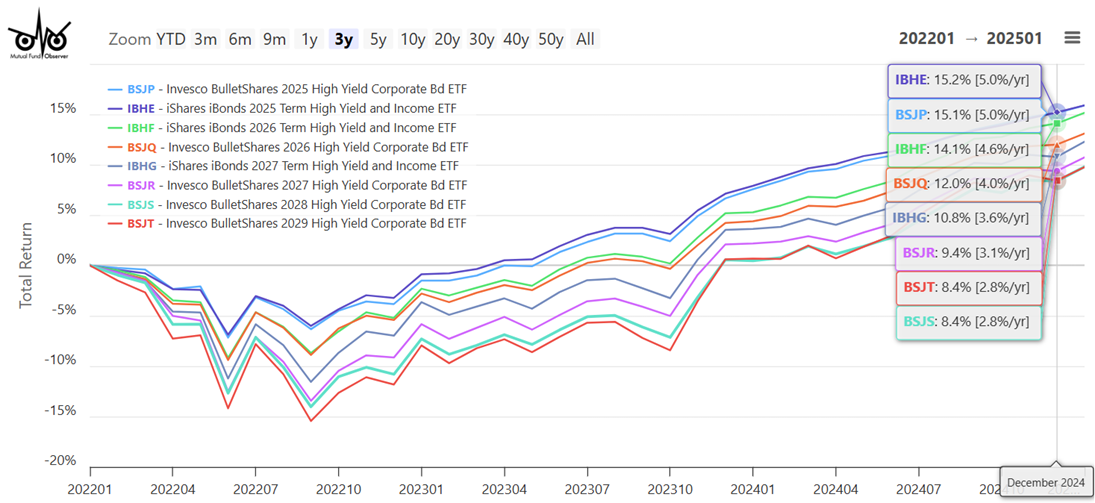

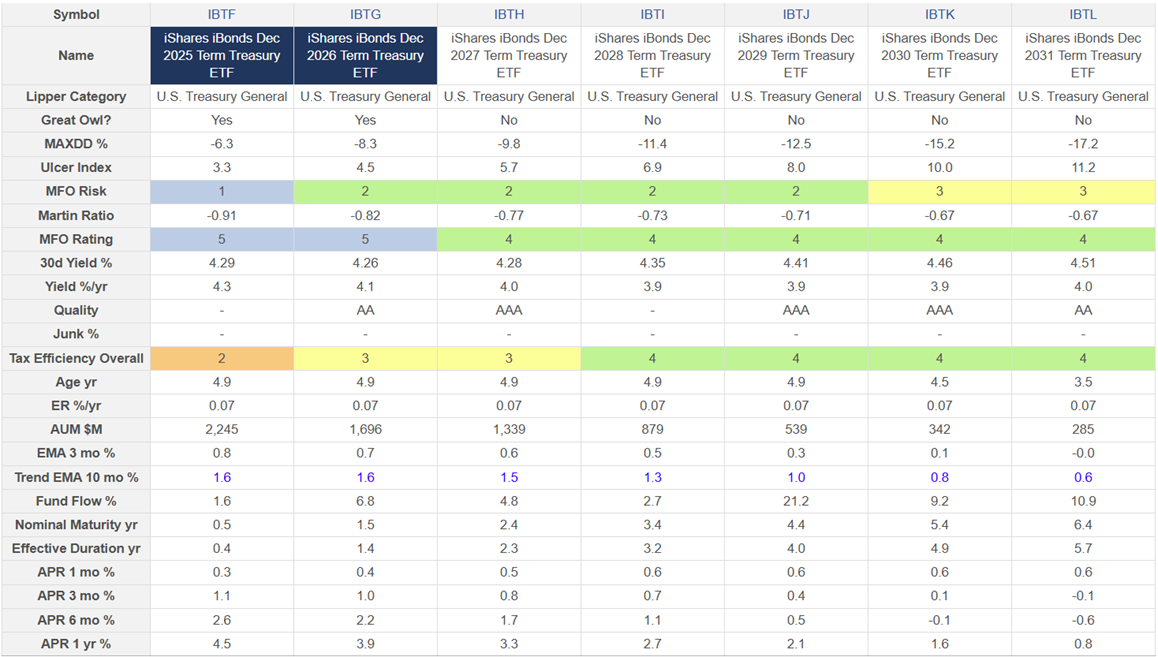

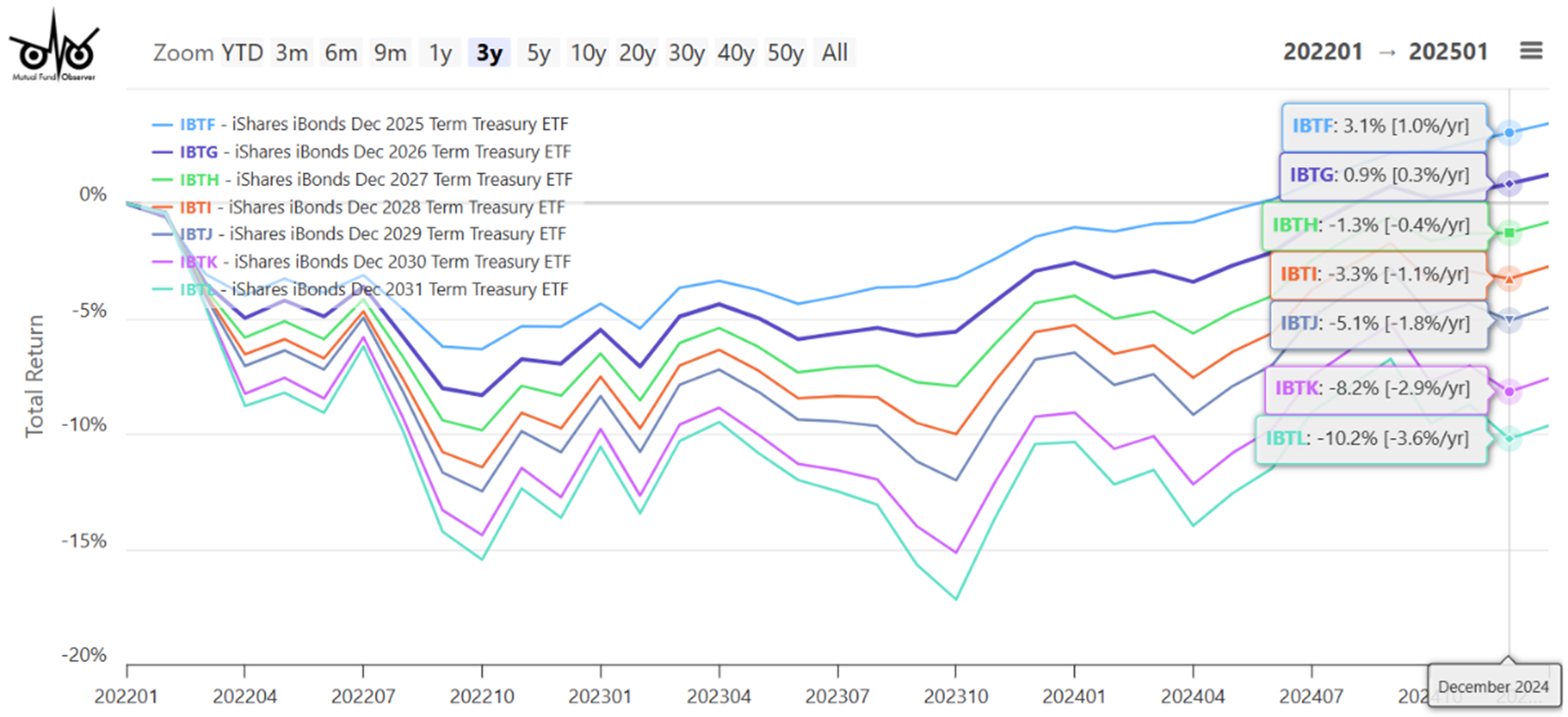

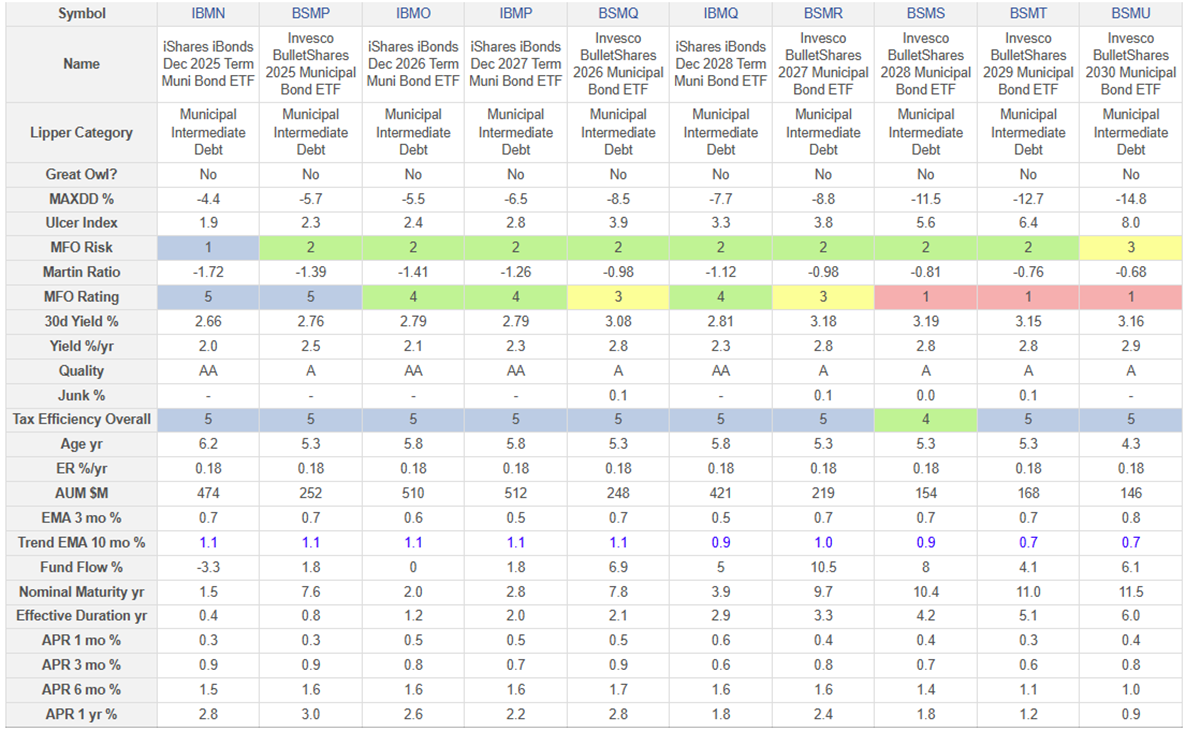

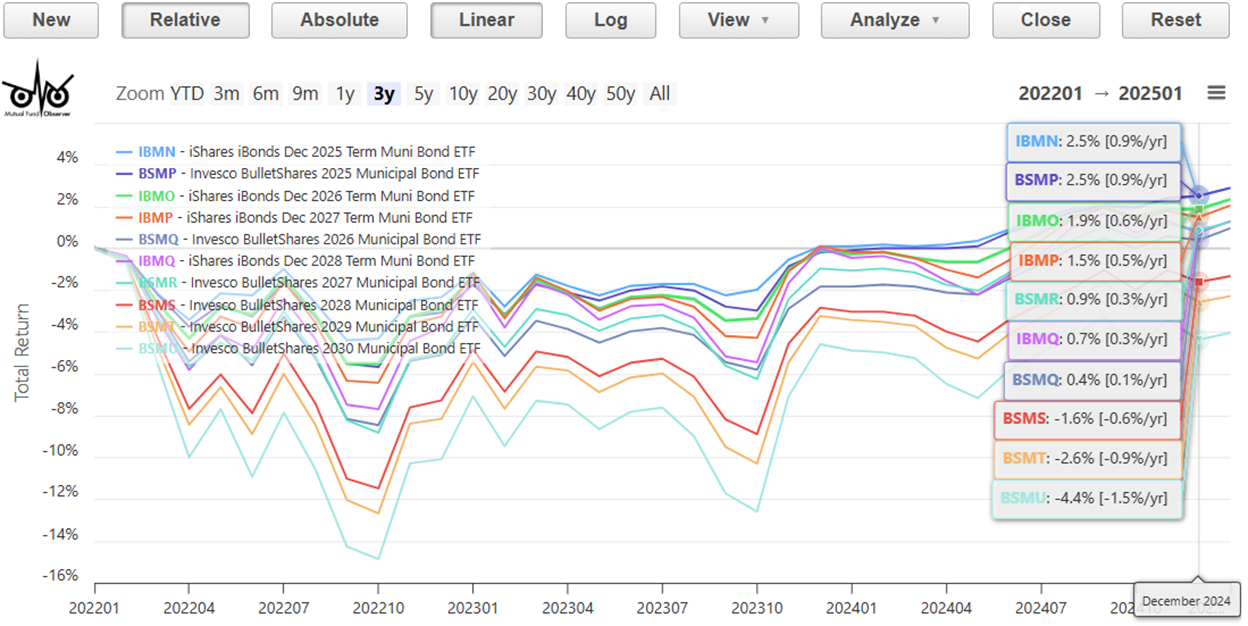

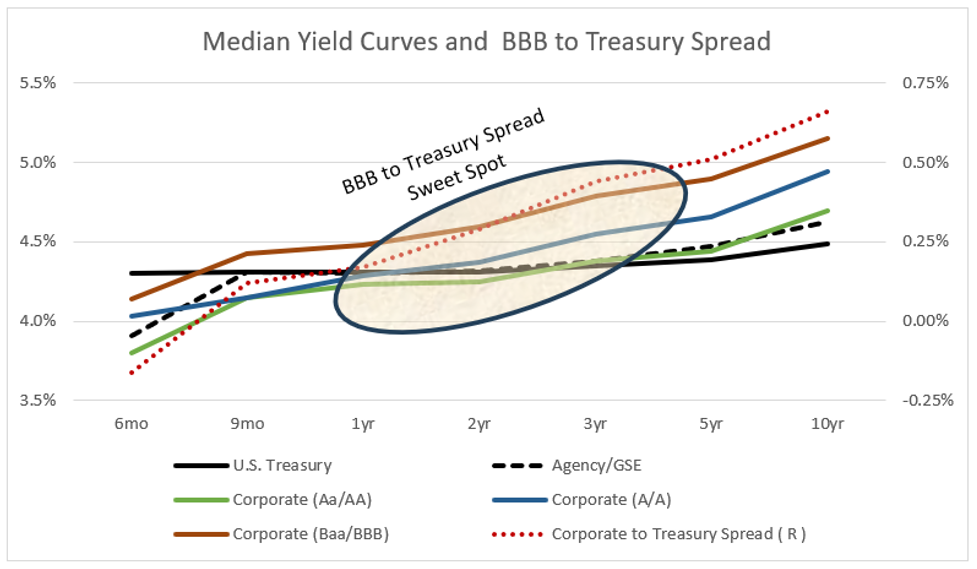

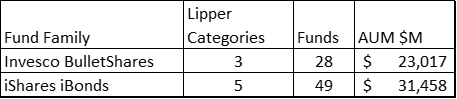

Lynn complements that with a new take on an old strategy, bond laddering. In “ETF Bond Ladders,” he examines ETFs designed for bond laddering, focusing on products from Invesco (BulletShares) and BlackRock (iShares iBonds). The essay concludes with the note that corporate BBB-rated bond ladders will be Lynn’s mainstay investment, with potential additions of high-yield bonds for near-term investments and municipal bonds for tax-efficient accounts.

In “The Great Rotation” (below), I highlight the surprising extent of the change in stock investors’ preferences – small, value, international, and emerging are being rediscovered – and offer up the funds that should be on an investor’s shortlist.

Not to put too fine a point on it, but the Trump administration has gutted efforts to minimize global warming, coordinate international responses to it, or maintain a credible information infrastructure for it. In January we noted that the necessary response to allowing such a collapse was a shift to infrastructure investing to manage the effects. In February, we extended the analysis to water infrastructure. In “The Climate Denial Profit Paradox,” we update the state of government efforts and lay out additional investing opportunities. (I’ll go back to being optimistic about the future next month.)

After markets get pricier and shakier, asset managers are doing what asset managers do: they’re rolling out new products in new asset classes using new algorithms that guarantee that happy days will be here again. After walking through the sad wreckage of other “can’t miss” innovations, we highlight the risks surrounding three new funds and ETFs in “Liquid Promises, Illiquid Reality.”

All of which brought to mind the stunning collapse of Firsthand Technology Value Fund, a tale that continues to this day. Launched in 1994, the fund returned 60% a year in the 1990s and gave rise to a half dozen siblings. Twenty years after launch it became a business development company doing private equity investing in the same sorts of tech companies. And ten years later, the fund is trading for $0.06/share and isn’t even able to liquidate. The cautionary tale is in “The Rise and Fall of Firsthand Technology Value Fund.”

Speaking of rising and falling, The Shadow documents the death of Matthews Asian Growth & Income, a fund made famous by Paul Matthews and Andrew Foster as the least volatile, most consistently excellent way to invest in Asia equities from 1994 to about 2011. But thereafter …

The Great Rotation

We can establish two things about the stock market with great confidence:

-

The US stock market has a giant problem. “Giant” in the sense that investors have poured money so steadily and so long into a handful of leaders that their valuations are beginning to redefine “irrational.” Jason Zweig notes, “Even after the stumble in tech stocks late last month, the Magnificent Seven traded this week at an average of 43.3 times what analysts expect them to earn over the next 12 months” (“What You Should Do About the Stock Market’s Giant Problem,” com, 2/7/25).

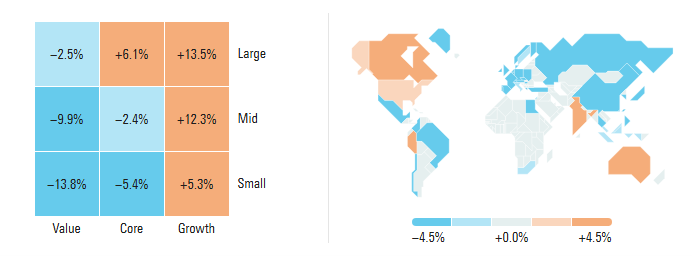

That leaves most of the US market and virtually all of the rest of the world with tolerable valuations. Spencer Jakab reports that “developed-market large growth stocks were trading last week at 98th-percentile valuations… [meaning] they have been more expensive only 2% of the time.” (Ever.) Simultaneously, “developed-market large value is at the 2nd percentile, so it has been cheaper only 2% of the time” (“Stocks have a big, expensive problem,” WSJ, 2/25/25, B10). Morningstar pictures it this way:

Leuthold Group reports that small caps are selling at a 26% discount to large caps, adjusted for earnings, and value is selling at a near-historic discount to growth.

-

Investors have noticed. As of March 3, 2025, Vanguard Value ETF is up 4.5% on the year, Vanguard Growth ETF is down 1.2%. Similarly, the Vanguard FTSE EM ETF is up 1.6%, Vanguard Total International Stock ETF is up 5.7% and the value-oriented Vanguard International High Dividend Yield ETF is up 6.6%.

Contrarily, the Roundhill Magnificent Seven ETF is down 6% YTD. Vanguard Mega Cap Growth ETF is down 2%. Tesla is down 27% YTD. Google is down 10%. Trump Media & Tech is down 32%.

All of this is separate from broader concerns about chaos, tariffs, reciprocal tariffs, escalating tariffs, government shutdowns, and burgeoning deficits.

What might an investor consider?

If you’re a young investor with a diversified portfolio (think more than 50 stocks representing many different industries, ideally spread over several countries), do nothing to your portfolio. You’re fine. This might be unpleasant, but that’s part of the price of playing the game.

If you’re an investor with all of your eggs in one small basket (you have a tech ETF and shares of Nvidia, Google, and Amazon), broaden your exposure. That doesn’t mean selling what you own. It might mean adding something like Invesco S&P 500 Equal Weight ETF (RSP). At base, the equal weight 500 counteracts the large/growth/momentum biases embedded in many portfolios. It gives equal exposure to the largest and smallest companies in the S&P 500 which creates an immediate contrarian balance. It is more oriented toward less expensive stocks, smaller stocks, old-economy stocks, and dividends than the S&P or the typical portfolio. In Morningstar terms, it is a one-star fund which is precisely its appeal: it invests in the companies left for dead by the FAANG/MAG7 mania.

If you want to increase your exposure to value-oriented stocks, consider Wisdom Tree US Value ETF (WTV) or Goodhaven Fund (GOODX). Why these two? We turned to the MFO Premium screener which allows us to assess open-end funds, closed-end funds, and exchange-traded funds side-by-side. We screeners for funds with three essential characteristics:

- High three-year information ratio: The information ratio measures a fund manager’s skill by comparing the excess returns generated (above a benchmark) to the volatility of those excess returns, indicating how consistently the manager outperforms their benchmark. It’s a sort of refinement of the Sharpe Ratio. A high information ratio is good; it signals a greater contribution by the manager or the model.

- Below-average Ulcer Index: The Ulcer Index measures downside risk by quantifying the depth and duration of drawdowns in an investment’s price, giving investors a clearer picture of potential “stomach pain” than traditional volatility metrics. It’s a key metric in MFO’s fund ratings. Low Ulcer indexes are good; they signal fewer ulcers.

- Available to regular investors: which is to say, reasonable minimum and not restricted to a limited class of buyers.

We applied that screener to large value, mid-cap value, and multi-cap value funds for the past three years. Thirty-four value funds and ETFs showed both excellent manager performance and excellent resilience over the past three years. Wisdom Tree US Value had the highest information ratio of all, and Goodhaven had the highest ratio for all mutual funds.

| Annual return | Info Ratio | Ulcer Index | ||

| Wisdom Tree US Value | Multi-cap value | 14.1 | 2.02 | 5.3 |

| Goodhaven | Multi-cap value | 14.6 | 1.44 | 5.3 |

| MCV average | 8.4 | -0.02 | 5.6 |

If you want to increase your exposure to small cap stocks, consider Vanguard Strategic Small Cap Equity, North Square Dynamic Small Cap, or Adirondack Small Cap.

Vanguard Strategic Small Cap Equity is an actively managed, low-cost small-cap blend fund that holds about 500 names (yikes! But it works) with a growth-at-a-reasonable-price discipline. It charges one-third of the category average and is about as diversified as can be.

North Square Dynamic Small Cap employs a systematic, quantitative approach to identify behavioral inefficiencies in small-cap equity markets, leveraging sophisticated data science to exploit pricing dislocations caused by investor biases. That “behavioral finance” angle is fairly distinctive.

Adirondack Small Cap is the top-performing small value fund, earning a remarkable 11% annual return in one of the market’s left-for-dead categories. The fund specializes in identifying undervalued small-cap companies that have fallen out of favor with investors, seeking to capitalize on these “turnaround situations” before mainstream investors take notice. They target companies that might rebound within three years. The team has been around forever and is heavily invested in the fund.

| Annual return | Info Ratio | Ulcer Index | ||

| Vanguard Strategic SC | Small cap core | 7.9 | 1.68 | 7.0 |

| North Square Dynamic SC | Small cap core | 9.5 | 1.64 | 7.2 |

| SCC Average | -3.9 | 7.9 | ||

| Adirondack SC | Small cap value | 11.1 | 1.14 | 5.8 |

| SCV Average | 4.9 | -0.02 | 7.4 |

If you want to increase your exposure to international stocks, consider the Janus Henderson Global Research or Moerus Worldwide Value. The Janus Henderson Global Research is a global large-cap growth fund that employs a distinctive sector-driven approach where specialized teams of dedicated sector analysts build high-conviction portfolios of their best ideas worldwide. They also work to hedge away most macroeconomic risks leaving the portfolio performance mostly driven by stock selection.

Moerus Worldwide Value is a globally unconstrained deep value fund managed by Amit Wadhwaney, who employs a disciplined approach to identifying companies trading at significant discounts to intrinsic value across developed and emerging markets, with a particular emphasis on strong balance sheets over income statements. Amit has three decades of value investing experience and willingness to embrace market turmoil as an opportunity, seeking out underfollowed businesses, complex situations, and temporarily distressed sectors that most investors avoid, creating a distinctive portfolio of 30-40 high-conviction holdings with minimal index overlap.

| Annual return | Info Ratio | Ulcer Index | ||

| Janus Henderson Global Research | Global large cap growth | 12.64 | 0.89 | 7.41 |

| Global LCG ave | 8.8 | -0.33 | 8.98 | |

| Moerus Worldwide Value | Global small-mid cap | 15.65 | 1.71 | 6.09 |

| Global small ave | 2.6 | -0.60 | 6.22 |

And if you’re simply freaked out, (a) welcome to the club and (b) increase the strategic cash allocation in your portfolio. Cash and cash alternatives are paying 4-5% a year with minimal downside. If you don’t have any great conviction in risk assets, take a deep breath and invest in some variation of an ultra-short bond fund or money market.

| Annual return | Maximum drawdown | Info Ratio | Ulcer Index | ||

| CrossingBridge Ultra-Short | Bond | 4.89 | -0.12% | 1.37 | 0.03 |

| Fidelity Conservative Income | Ultra-short bond | 4.43 | -0.21 | 0.8 | 0.06 |

| Random money market fund | The group average | 4.24 | 0.0 | -0.95 | 0.0 |

CrossingBridge is run by David Sherman & co., and they have an outstanding record of low-risk income investing. Fidelity Conservative Income is a cheap, active, middle-of-the-road ultra-short bond fund. The “cheap” is really useful here. We’ve also included the profile of the money market peer group. In reality, there’s no downside to any of them and precious little upside deviation. So, the whole group sits at 4.2% give-or-take 0.2%. Pick whichever one is convenient to you if you don’t want the prospect of adding just a bit of upside with CrossingBridge or Fido.

The bottom line: running around in panic is not your friend. Hiding is not your friend. Taking a deep breath and making rational adjustments is. We’ll help.

Celebrating Ethical Business: B Corp Month

March has been designated as “B Corp Month.” Hallmark has not yet taken notice.

March has been designated as “B Corp Month.” Hallmark has not yet taken notice.

In an era of growing disillusionment with traditional corporate structures, B Corps stand as beacons of a more conscientious approach to business. While many companies prioritize profits at any cost, Benefit Corporations (B Corps) represent a revolutionary paradigm that balances financial success with positive social and environmental impact.

B Corps are businesses that meet rigorous standards of social and environmental performance, accountability, and transparency. Unlike conventional corporations that answer primarily to shareholders, B Corps legally commit to considering all stakeholders: workers, customers, suppliers, community, and the environment. In the US, 2,400 corporations are organized as B Corps. Worldwide, that swells to 9,500.

What makes B Corps worth celebrating? They’re proving that business can be a force for good. From fair wages and diverse workforces to sustainable sourcing and ethical production, these companies demonstrate that profit and purpose aren’t mutually exclusive, they’re mutually reinforcing.

What makes B Corps worth celebrating? They’re proving that business can be a force for good. From fair wages and diverse workforces to sustainable sourcing and ethical production, these companies demonstrate that profit and purpose aren’t mutually exclusive, they’re mutually reinforcing.

The B Corp movement isn’t just idealism; it’s pragmatism for our times. As consumers increasingly vote with their dollars for companies that reflect their values, B Corps are showing that ethical business practices create resilience, innovation, and long-term success. The Annual Report of B Lab documents a lot of ways in which these companies really are different.

I am not surprised, though I am slightly appalled, by the speed with which Corporate America as a whole has thrown all principles except shareholder (and executive) gains under the bus. By supporting the good guys, you aren’t underwriting the swift abandonment of employees, communities, and the environment by the billionaire-dollar corporations that were cheerleading for it, flying rainbow flags, and signing on to global initiatives … for precisely as long as it was convenient.

Support how?? Follow B Lab Global, the certifying body, on social media (LinkedIn, Instagram, Facebook, X) and follow the #GenB or #BCorpMonth hashtag to see the different stuff happening throughout March. You can also use the ‘Find a B Corp’ directory to discover businesses that are part of the community and use your purchasing power to support B Corp companies, and the movement of business as a force for good.

And other good guys

![]() You might also consider Bookshop.org as an ethical alternative to Amazon, at least as a bookseller. They’ve donated $36+ million in profits to local bookshops since their launch during Covid. Nice people, good selection. Amazon has recently changed policy, they now forbid Kindle users from downloading their books, giving them permanent control of your purchases. (You might recall their freakish decision to remove the book 1984 from all Kindle readers a few years ago.) Bookshop has e-books and is working with folks like Kobo to make them available on readers.

You might also consider Bookshop.org as an ethical alternative to Amazon, at least as a bookseller. They’ve donated $36+ million in profits to local bookshops since their launch during Covid. Nice people, good selection. Amazon has recently changed policy, they now forbid Kindle users from downloading their books, giving them permanent control of your purchases. (You might recall their freakish decision to remove the book 1984 from all Kindle readers a few years ago.) Bookshop has e-books and is working with folks like Kobo to make them available on readers.

Similarly, a handful of major retailers have recognized the business case of sustaining a diverse and vibrant workforce and have, to date, refused to roll back corporate efforts to support their employees. Those include Costco, Crate & Barrel, Home Depot, Ikea, Kroger, Sprouts Wayfair, West Elm … and Whole Foods (?).

Thanks, as ever …

To our faithful “subscribers,” Wilson, S&F Investment Advisors, Greg, William, William, Stephen, Brian, David, and Doug, thanks!

To our faithful “subscribers,” Wilson, S&F Investment Advisors, Greg, William, William, Stephen, Brian, David, and Doug, thanks!

To, Sara from Brooklyn, Charles of Michigan, Ronald from Alexandria, Marjorie (thank you, ma’am, I also get such a headache some days) of Chicago, The Grinch Redux, and dear Binod from Houston, thanks! And for more than just financial support. You make a difference.

It’s planting time. Chip is busily searching seed catalogs for spring-planted garlic (stiff neck mostly, because they generate delicious garlic scapes) and mild onions. I’ll continue searching for the perfect potato. And somewhere in there, more native wildflowers and grass (sheep fescue looks cool) will continue their relentless incursion on our lawn.

Planting is an act of hope. Gardening is a gesture of resilience. Pursue both, dear friends.

As ever,